Helping you focus on what’s most important to you

At RBC Dominion Securities, we have provided professional wealth management to families, businesses and organizations since 1901. Today, as Canada’s leading provider of wealth management*, we guide over 420,000 clients like you based on one simple idea: to help you focus on what’s most important to you. Whether that’s building a solid future for your family, living your retirement lifestyle or creating a lasting legacy for future generations, we’re here to help.

We help by providing personalized investment advice and money management to address your needs for growth, income or capital preservation. But we go beyond that to focus on your overall wealth picture, with the support of our RBC Wealth Management team of experts in areas like tax, estate and financial planning. We also work in close collaboration with your existing professional advisors, to align your various financial, investment and philanthropic goals.

Your road map for the future

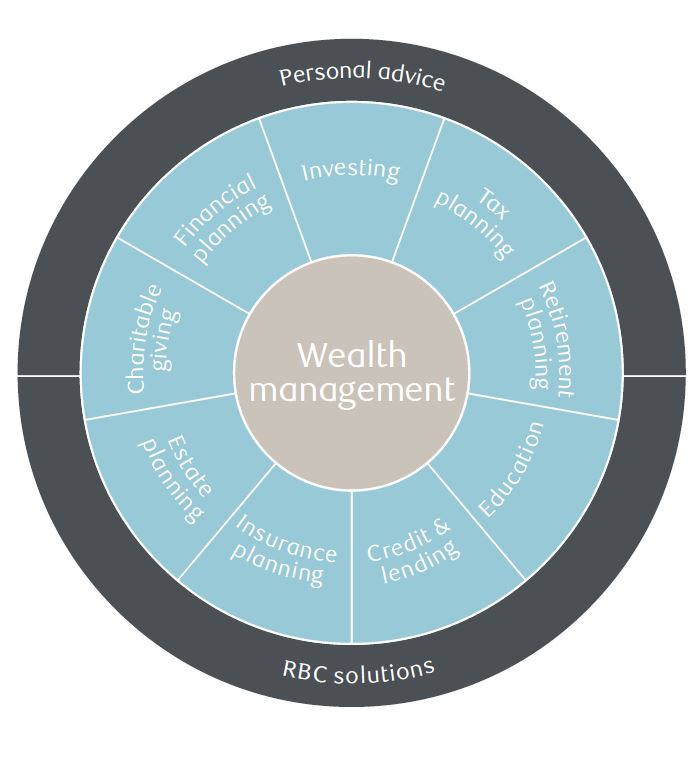

Wealth management is a comprehensive approach to achieving financial and life goals. It extends beyond investment advice and money management, encompassing lifestyle protection, retirement planning, intergenerational wealth transfer and legacy creation. Wealth management provides the confidence to make sound financial decisions, plus the freedom to live life as envisioned. It also provides a clear road map for the future by addressing all financial aspects at each life stage. Every step of the way, we will be there as a personal guide.

With the wealth management approach, we help:

•Clarify individual needs

•Establish specific goals

•Bring together all the solutions needed to effectively manage wealth

Achieve your goals with confidence

Institutional investment management

Vincent Bonnet will manage your investments through an innovative platform called A+ that gives you convenient access to a professionally managed, fully customized investment portfolio. A+ provides access to some of the world’s leading investment managers, backed by RBC’s proven investment discipline.

With your customized A+ portfolio, you can be confident that your portfolio will be managed according to the highest standards. In consultation with you, your fully customized portfolio will be constructed with such factors as your growth requirements, income needs and risk tolerance in mind.

Your customized A+ portfolio provides:

•The expertise of leading independent asset management firms, carefully assessed through in-depth research, and brought together in a coordinated, customized portfolio

•A sophisticated, tax-efficient portfolio that gives you direct ownership of the individual investments in your portfolio, providing greater control over taxable events

•The latest portfolio management technology that brings together multiple asset managers into a single, unified portfolio with consolidated reporting and synchronized asset allocation

•A proven investment discipline that ensures your portfolio is set, monitored and rebalanced according to your specific investment guidelines

•A modern approach that enables you to achieve capital growth, without compromising on your personal values\

Managing risk through enhanced diversification

Diversifying your investments is the golden rule for reducing risk. Your A+ portfolio benefits from three levels of diversification through our “multi-asset, multi-style, multi-manager” approach:

1. Multi-asset

First, we diversify your portfolio by asset class – between equities, fixed-income and cash – to help achieve your specific long-term investment objectives while managing risk.

2. Multi-style

Next, we diversify your portfolio by investment style, carefully combining portfolio managers who specialize in different investment styles, such as growth and value.

3. Multi-manager

Finally, we diversify your portfolio by investment manager, mitigating the risks associated with investing with a single asset manager.

Wealth management services

To help you meet your various goals, we take a comprehensive approach that extends beyond investing to encompass lifestyle protection, retirement planning, intergenerational wealth transfer and legacy creation, drawing on the expert support of the RBC Wealth Management Services team. By drawing on the RBC Wealth Management Services’ team of highly accredited lawyers, accountants and financial planning professionals, we are able to deliver the level of integrated wealth management expertise that previously was available only to the most affluent families.

Financial planning

We can provide a core financial plan suitable for most situations or, for more complex situations, an in-depth financial plan that leaves no stone unturned.

Will and estate consultation

For complex or high-value estates, a professional Will & Estate Consultant provides information on tax-efficient estate structuring. Following the consultation, a report outlining various estate-planning opportunities will be provided to explore in further detail, and potentially implement, with legal counsel.

Insurance assessment

A highly qualified Estate Planning Specialist assesses the need and suitability of tax-exempt insurance products to help create and enhance wealth, both today and in the future.

Analysis of tax reduction strategies

Strategic tax-minimization review Working with our in-house tax specialists, we can review the effectiveness of particular investment strategies that may minimize or mitigate taxes.

Business owner planning

Our business owner specialists can develop an all-encompassing plan focused on a business owner’s personal and corporate planning objectives. Strategies related to business risk, transition, succession, retirement, and tax are identified and evaluated to address planning needs.

High-net-worth planning

A high-net-worth planning specialist is available to discuss the specific concerns and opportunities that arise when dealing with above-average financial assets.

Each step of the way, you will have the personal attention of Vincent Bonnet, your own dedicated wealth manager. We invite you to learn more about how Vincent can help you achieve what matters most to you.